🇷🇺 Economy At The Start Of 2025: Underlying Vulnerabilities, Depleted Macro Buffers, But No Signs Of An Immediate Crisis

KSE Institute has released its new January Russia Chartbook “The Russian Economy At The Start Of 2025: Underlying Vulnerabilities, Depleted Macro Buffers, But No Signs Of An Immediate Crisis.” Ukraine’s allies must maintain a coordinated and consistent approach to uncover Russia’s economic vulnerabilities, further complicating its economic management.

Russia’s external environment remained supportive in 2024, with a current account surplus of $53.9 billion, slightly exceeding $50.1 billion in 2023. However, the surplus weakened significantly in the second half of the year, falling to $12.6 billion from $41.3 billion in the first half. Goods imports rose by $19 billion in the second half, while service and income transfer deficits increased by $5 billion each. Oil and gas exports grew by 2%, adding $6 billion due to higher prices, but exports of other goods declined by 7%, resulting in a $13 billion loss.

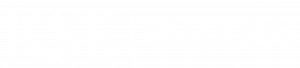

The federal budget deficit in 2024 reached 3.5 trillion rubles, equivalent to 1.7% of GDP or about $39 billion. This aligns with the deficits of the previous two years in ruble terms. Revenues from oil, gas, and non-oil sectors increased by 26% compared to 2023, helping to offset a 24% rise in spending. Despite this, the full-year deficit significantly exceeded the planned 1.6 trillion rubles. In December, the 3.1 trillion ruble deficit was financed through a 1.3 trillion ruble transfer from the National Welfare Fund and 2 trillion rubles in domestic debt issuance, supported by a Central Bank repo operation.

Russia’s macroeconomic buffers remain under pressure. The liquid assets of the National Welfare Fund have declined to 3.8 trillion rubles, a 60% drop since February 2022. With hard currency reserves depleted by the end of 2023, Russia sold yuan-denominated assets and gold in December to cover the budget deficit. At current prices and exchange rates, the fund’s liquid assets amount to $37.5 billion, which are close to depletion for budgetary needs. Meanwhile, an estimated $340 billion of Central Bank reserves remain frozen due to sanctions, limiting monetary policy options, with the location of approximately 85% of these assets identified.

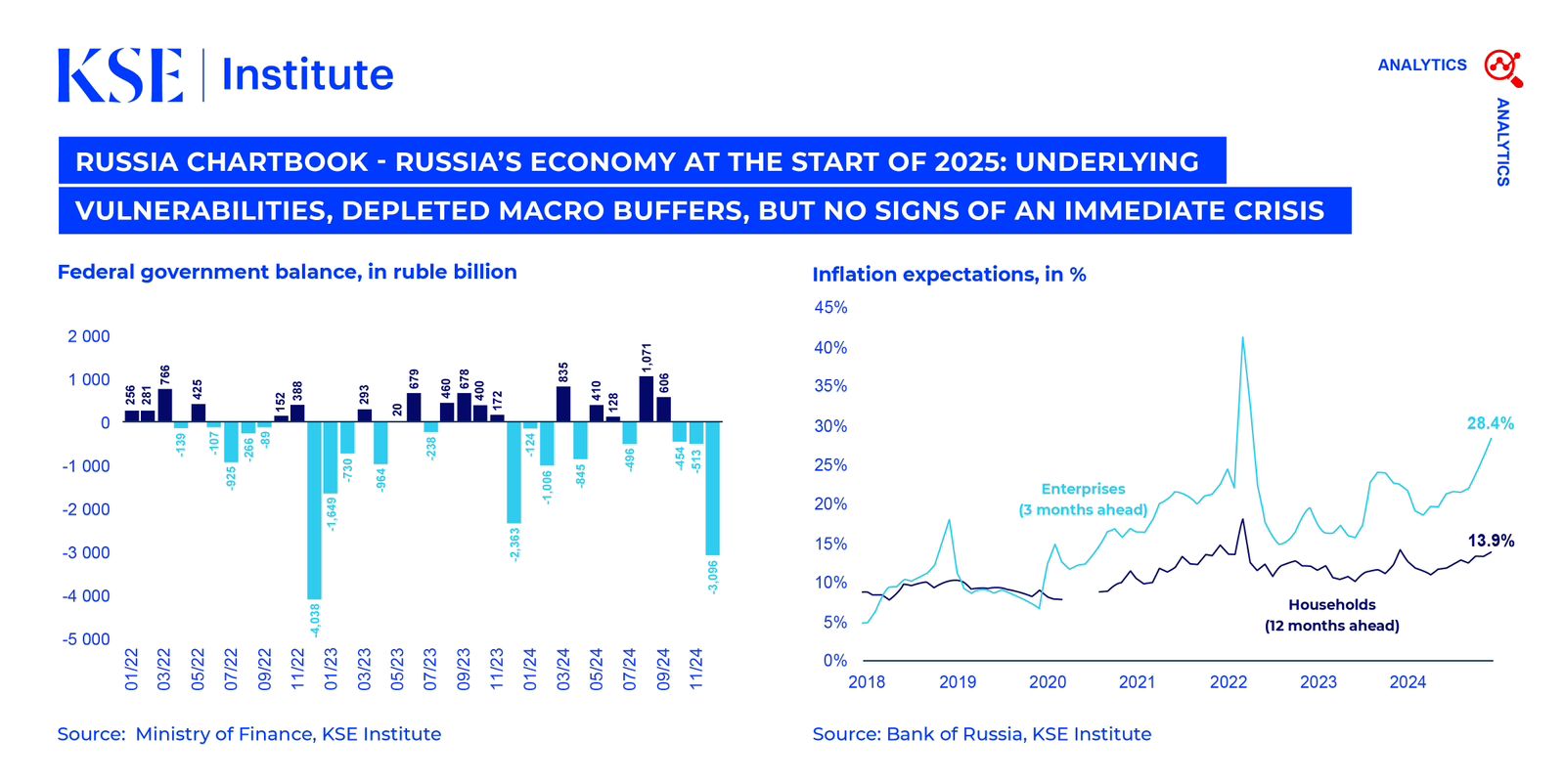

While the Russian economy faces serious vulnerabilities, there is no immediate crisis. GDP growth in 2024 is estimated at around 3.5%, similar to 2023. This growth was supported by increased government spending on the war, a surge in private sector bank loans, and a tight labor market. However, these factors, along with ongoing ruble depreciation, pushed inflation to 9.5% year-over-year in December. Despite the Central Bank’s significant interest rate hikes of 1,350 basis points since mid-2023, inflation remains high due to compromised monetary policy transmission.

Contacts