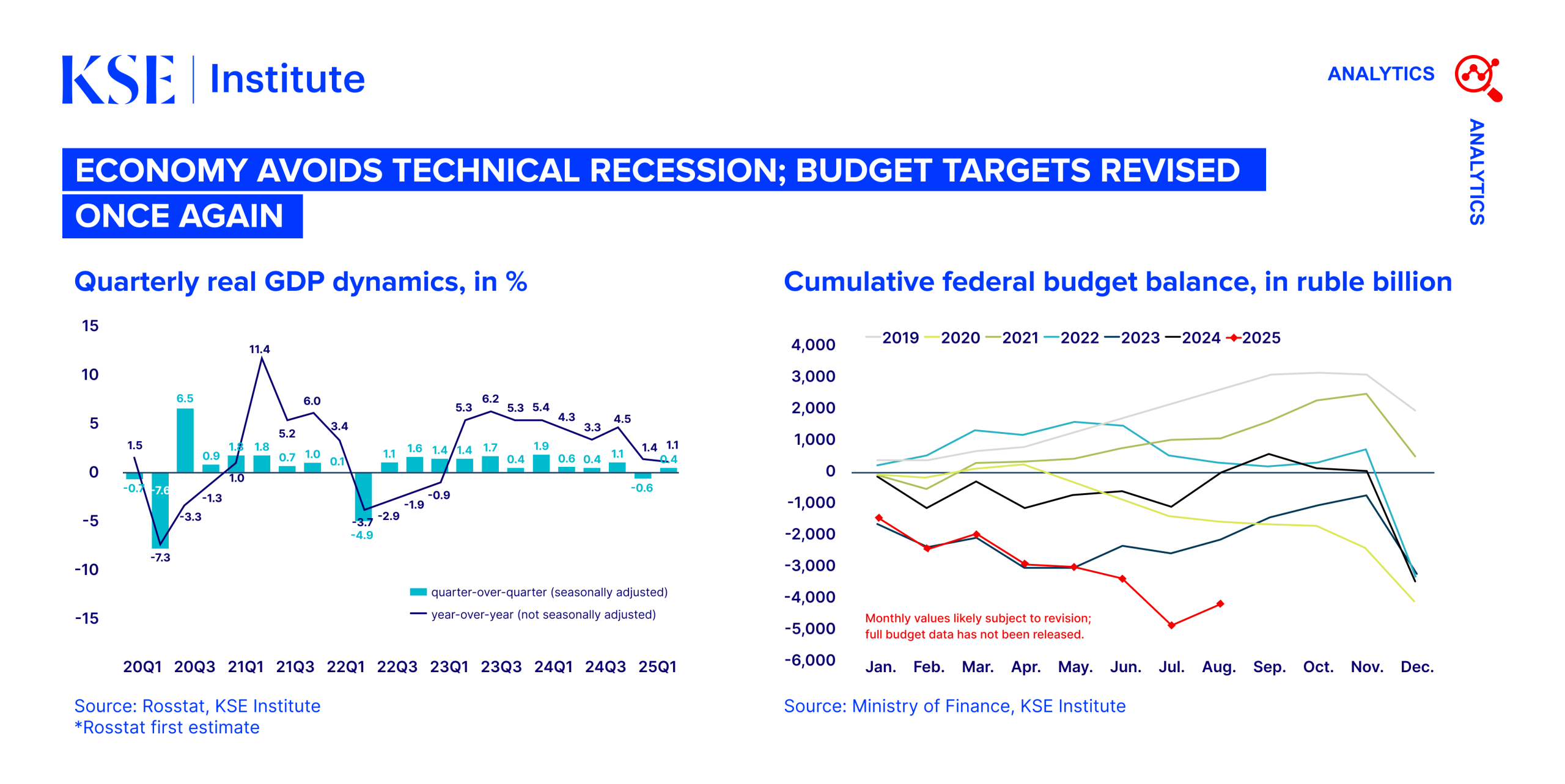

Economy Avoids Technical Recession; Budget Targets Revised Once Again

KSE Institute has published the September edition of its Russia Chartbook: “Economy Avoids Technical Recession; Budget Targets Revised Once Again.” Russia’s deepening fiscal and economic challenges offer Ukraine’s allies an opportunity to intensify sanctions and financial pressure, further limiting the Kremlin’s ability to sustain its war efforts.

The Russian economy grew by 0.4% in the second quarter of 2025 compared to the first, following a 0.6% contraction in the first quarter, which helped avoid a technical recession. Annual growth is likely to reach around 1%, but prospects remain limited with no significant acceleration expected in the coming years. The CBR reduced inflation to 8.1% in August from approximately 10% in January-May through tight monetary policy, though this has complicated loan access for businesses and households. Despite cutting rates from 21% to 17%, real interest rates remain high. Persistent issues like elevated budget deficits and a tight labor market linger, while Ukrainian attacks on Russian refineries may raise fuel prices, intensifying the conflict between the CBR’s price stability goals and the government’s priorities of war financing and economic stimulus.

From January to August 2025, the budget deficit totaled 4.2 trillion rubles, an improvement from 4.8 trillion over January-July. Oil and gas revenues declined by 20% year-over-year, while non-oil revenues rose by 14%, and expenditures increased by 21%. Authorities raised the full-year deficit target to 5.7 trillion rubles due to weaker revenues, keeping spending unchanged. Based on current performance and past trends, Russia is likely to exceed this new target. For 2026, the Ministry of Finance proposes increasing and expanding VAT to offset declining oil and gas revenues. While plans are often adjusted for war needs, Russia intends to maintain stable military and security spending, marking a shift from the sharp increases of recent years.

The NWF’s liquid portion remained stable at 4.0 trillion rubles ($49 billion) in August, accounting for 30% of total assets compared to 75% in February 2022. Without fiscal consolidation, the NWF may deplete its liquid assets by year-end due to large deficits. Authorities could ramp up domestic borrowing, as seen with OFZ issuance reaching 3.3 trillion rubles from January to August — a 104% year-on-year increase and 68% of the original plan. While yields remain moderate, the flat yield curve signals concerns about medium-term prospects. Russia is likely to finance its growing deficit by incentivizing banks to purchase additional issuance through repo schemes.

Contacts