Lower Oil Prices Weigh on Exports, Revenues; Early Budget Revision Indicates Challenges

KSE Institute has published the May edition of its Russia Chartbook: “Lower Oil Prices Weigh on Exports, Revenues; Early Budget Revision Indicates Challenges.” Ukraine’s allies should leverage Russia’s growing financial difficulties and shrinking macroeconomic buffers to increase sanctions and financial pressure, further constraining the Kremlin’s ability to fund its war.

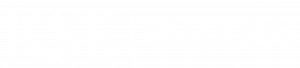

In April 2025, Russia’s oil export earnings fell to $13.2 billion — the second-lowest level since energy sanctions were introduced. The average price of a barrel of Russian oil remained below $60 for the second month in a row, which is associated with global market trends and decisions made by OPEC+ countries. If this situation continues, Russia’s external accounts could come under significant pressure. In January–April 2025, oil and gas budget revenues decreased by 10% compared to the same period in 2024.

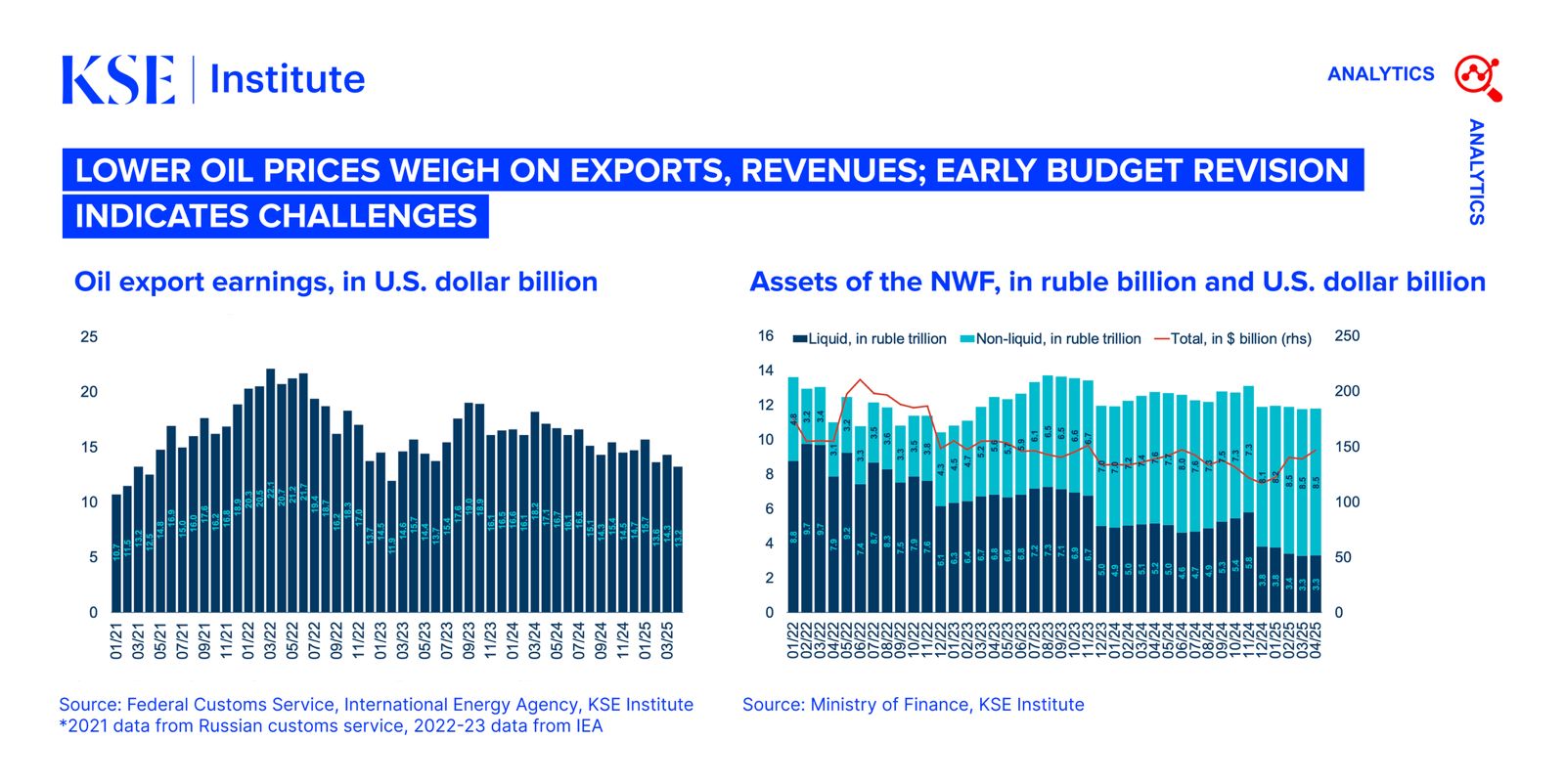

In April, Russia was forced to conduct a revision of its federal budget — earlier than at any point in recent history. The updated forecast lowered expected oil and gas revenues by 24% and raised planned expenditures by 3%, whereas the expected full-year budget deficit was tripled — from 1.2 trillion to 3.8 trillion rubles. Over the first four months of the year, the deficit already reached 3.2 trillion rubles, or 85% of the revised annual plan.

Russia’s macroeconomic buffers remain under pressure. As of April 2025, the liquid part of the NWF stood at 3.3 trillion rubles — down 66% from pre-invasion levels and now smaller than the revised annual deficit. To cover the budget gap Russian MinFin increasingly relies on domestic borrowing, however, interest in federal bonds remains weak among Russian banks.

Inflation remained high in April — 10.2% year-on-year, only slightly below the March figure (10.3%). Core inflation and inflation expectations also remain elevated. Despite the key interest rate holding at 21%, inflationary pressures persist, driven by labor shortages, accommodative fiscal policy, and rapid credit growth.

Economic growth is slowing. In Q1 2025, real GDP rose by just 1.4% (compared to 4.5% in Q4 2024). Growth is expected to slow further to 1–2% over the course of the year due to tight labor markets, higher borrowing costs, and weak investment. Against this backdrop, companies are increasingly unable to afford significant wage increases — a trend already emerging in recent months.

Contacts