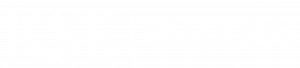

Russian oil export revenues reached the lowest level since the start of the full-scale invasion, India’s imports decreased by 40%

In November 2025, Russia’s oil export revenues decreased by ~$1.9 bn MoM to $11.0 bn, according to the December edition of the Russian Oil Tracker by the KSE Institute. This is the lowest level since the start of the war. Revenues from crude oil exports fell by $1.6 bn to $7.1 bn, while revenues from oil products declined by $0.3 bn to $3.9 bn.

Russian seaborne oil exports decreased by 7.2% MoM and by 5.4% YoY. Tankers with International Group (IG) P&I insurance coverage shipped 21% of crude and 66% of oil products. Russian reliance on Western maritime services decreased to 36%.

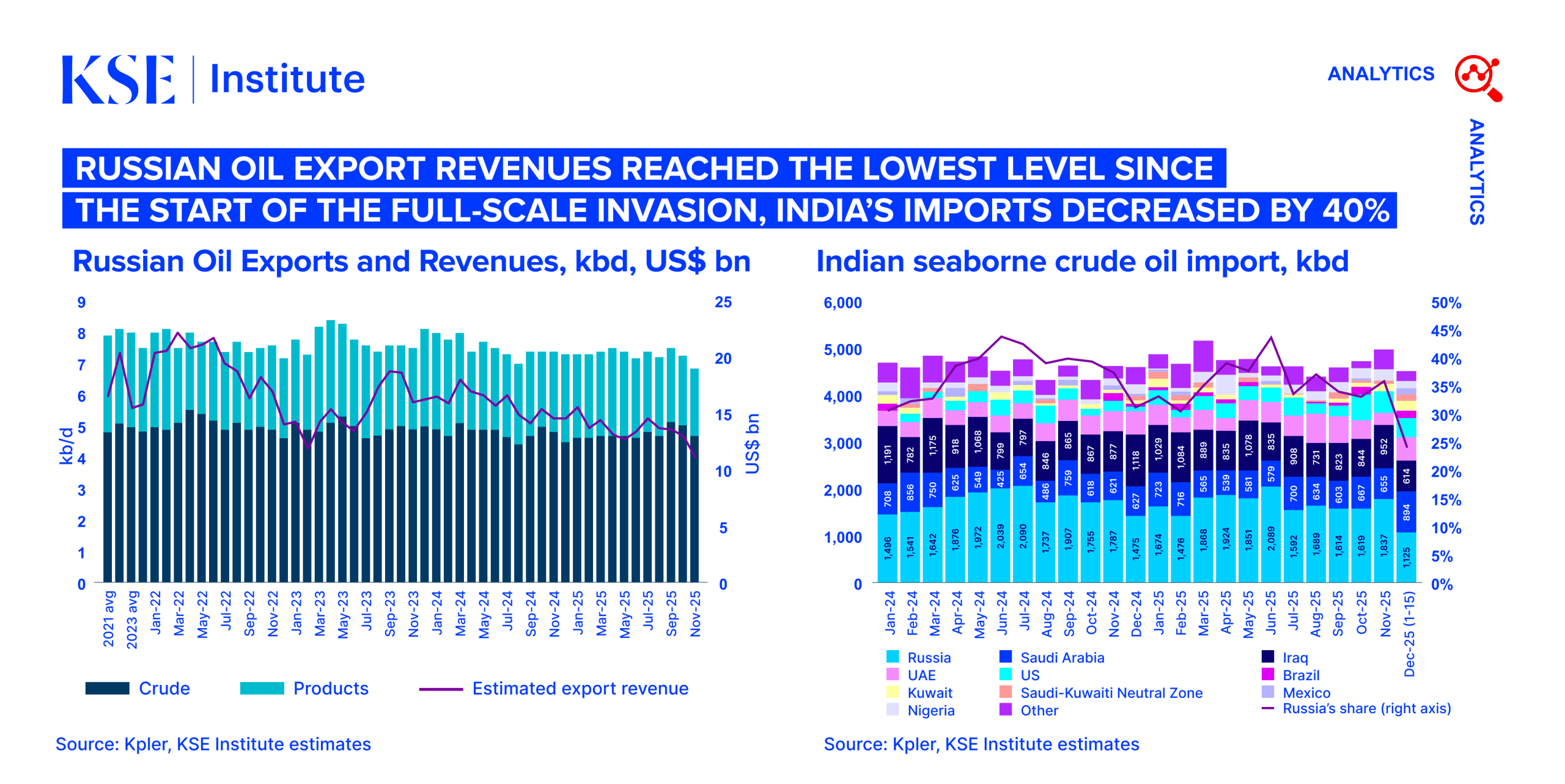

During the first 15 days of December, India imported on average 1.17 mb/d of Russian oil — down 40% MoM and hitting the lowest level since November 2022. India’s largest company, Reliance Industries Ltd. (RIL), reduced its purchases by 42% MoM, while HMEL, MRPL, and HPCL took no barrels at all. At the same time, China did not lower Russian oil imports. However, Sinopec is projected to cut its purchases by 50% MoM, while Shandong Yulong has remained an active buyer since April 2025. Turkey’s imports of Russian oil rose by 27% MoM, driven by higher volumes of oil products despite a decline in crude oil shipments, with Tupras cutting purchases by 21% MoM and Koç Group doubling volumes, remaining in line with 2024–2025 levels.

Higher purchases were detected from Russian companies such as RusExport (India, China, and Turkey) and MorExport (India and China), while shipments from sanctioned companies as Lukoil, Gazprom, Russneft, and Surgutneftegas to these three countries declined significantly or stopped entirely.

As of 17 December, Russian crude on water reached 158 mb — the highest level since at least 2024, up 39% from mid-July (following the EU ban on Russian oil products in third countries) and 16% higher than on 21 October (following U.S. sanctions on Rosneft and Lukoil), while oil product volumes remained stable at ~70 mb.

In November, average Urals FOB Primorsk and Novorossiysk declined by $8.2/bbl and $9.4/bbl MoM to ~$43.5/bbl and ~$42.6/bbl and traded below the EU’s revised price cap. ESPO FOB Kozmino decreased by $5.5/bbl to $53.9/bbl in November and still traded significantly above the revised price cap. Both premium and discounted products were traded below the unchanged price caps.

The shadow fleet continues to play a key role in transporting Russian oil. According to KSE Institute estimates, in November, 173 Russian shadow fleet tankers carrying crude oil and oil products departed Russian ports and engaged in ship-to-ship (STS) transfers. Of these vessels, 78% were older than 15 years.

At the same time, Russian crude oil exports via the shadow fleet increasingly rely on tankers sailing under false or unknown flags. Since May, such vessels have been used more actively, and by November their share in the transportation structure remained significant, indicating a systematic strengthening of sanctions circumvention. In November, these tankers — together with vessels sailing under the flags of Sierra Leone and Cameroon — accounted for 61% of all crude oil volumes transported by the shadow fleet.

The EU, US, UK, Canada, Australia, and New Zealand have collectively designated 621 Russian oil tankers, but the total number of designated tankers still loading in Russia continues to rise gradually each month, highlighting weak sanctions enforcement.

According to KSE Institute modelling, in the base case with current oil price caps and status quo of sanctions, revenues will reach $156 bn in 2025 and $106 bn in 2026 (compared to $189 bn in 2024 and $185 bn in 2023). In 2027 they are projected to increase to $122 bn as loosening oil markets will not enable them to recover more. If the discounts on Urals and ESPO grades are widened to $25/bbl and $15/bbl compared to Brent forecast prices, revenues are expected to fall to $67 bn in 2026 and $87 bn in 2027. However, in case of weak sanctions enforcement, Russian oil revenues could reach $133 bn and $156 bn in 2026 and 2027, respectively.

Contacts