Russian Oil Revenues Rising, Tougher Sanctions Needed on Shadow Fleet

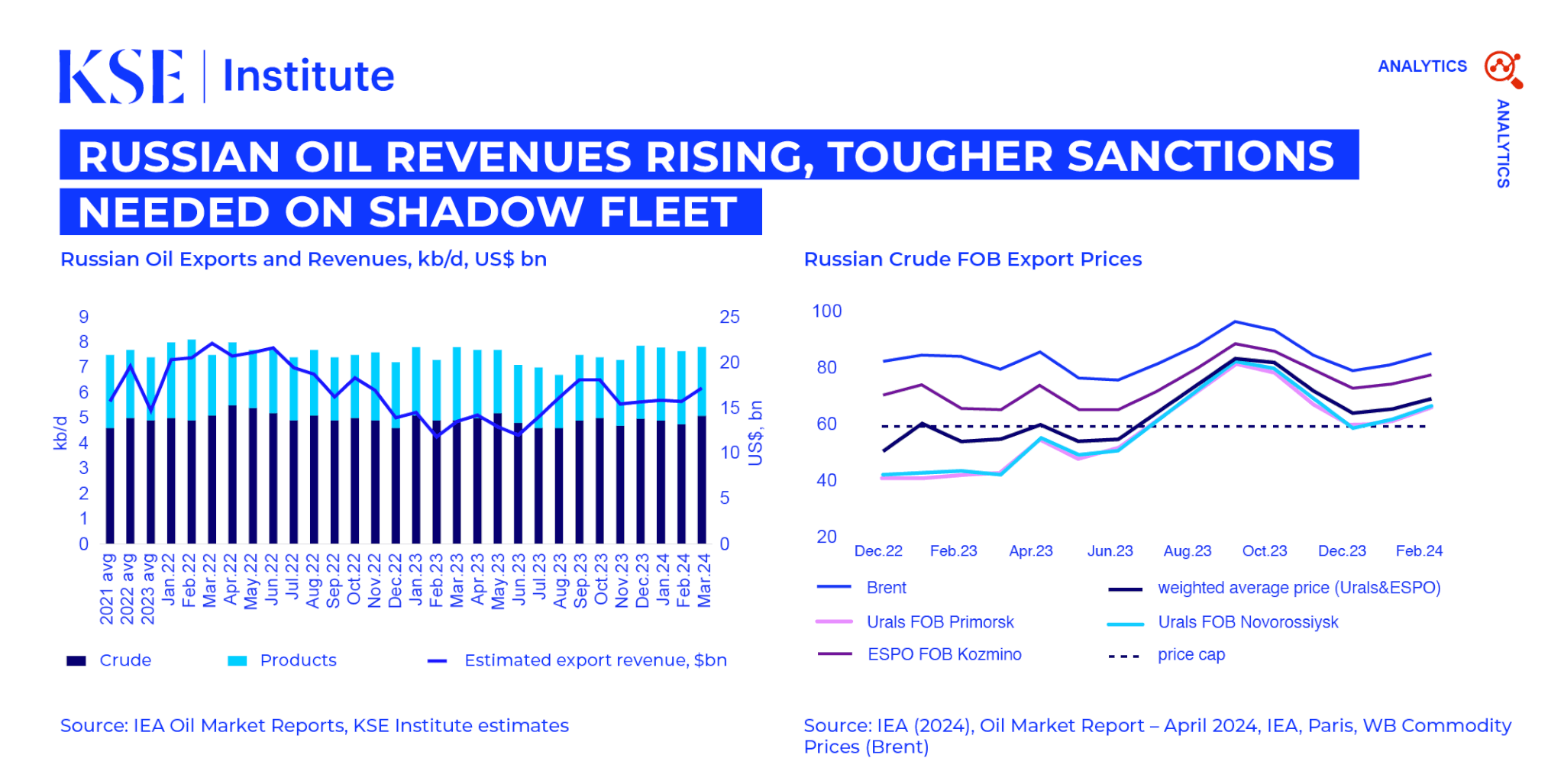

Russian oil export revenues surged to $17.2 billion in March 2024, driven by higher global oil prices and increased crude export volumes, according to the April ‘Russian Oil Tracker’ by KSE Institute. Despite robust US Treasury sanctions targeting the shadow fleet, Russia continues to expand it by incorporating new tankers, allowing for stable exports and further evasion of oil price cap.

Russian oil export revenues surged to $17.2 billion in March 2024, driven by higher global oil prices and increased crude export volumes, according to the April ‘Russian Oil Tracker’ by KSE Institute. Despite robust US Treasury sanctions targeting the shadow fleet, Russia continues to expand it by incorporating new tankers, allowing for stable exports and further evasion of oil price cap.

Russian seaborne oil exports rose by 4% in March, driven by a 12% increase in crude oil shipments (+400 kb/d), while exports of oil products declined by 6%. Notably, India saw a 3% increase in Russian crude imports (to 1,445 kb/d), maintaining its position as the top importer of Russian crude oil. Meanwhile, Turkey has been meeting around two-thirds of its oil demand through Russian oil products imports, with total imports exceeding 800 kb/d since November 2023.

However, only 36% of Russian oil exports were shipped by IG-insured tankers. For other shipments, Russia utilized its shadow fleet. It was responsible for exports of ~2.8 mb/d of crude and 1.1 mb/d of oil products in March.

Specifically, 223 loaded non-IG-insured tankers left Russian ports, with 2 engaged in STS transfers in March 2024. With 85% of these tankers aged over 15 years, the risk of oil spills at sea is heightened—a potential catastrophe for which Russia would likely refuse to pay.

The US Treasury’s strategy of designating individual vessels effectively removes shadow tankers from regular commercial service. As of April 12, 2024, out of 41 sanctioned vessels, 37 were unloaded and not scheduled for further voyages, while 3 were completing their current voyages in line with the OFAC authorization. One vessel provides coastal shuttle services violating OFAC’s sanctions but only within the Black Sea. On April 4, OFAC also sanctioned Oceanlink Maritime Dmcc and its 13 tankers for its ties with Iran but 7 of these 13 tankers also shipped Russian crude without IG P&I insurance.

Russia managed to expand its shadow tanker fleet, adding 35 new tankers to replace 41 tankers added to OFAC’s SDN list since December 2023. These tankers, all over 15 years old, are managed outside the EU/G7. Nine of them were directly involved in loading Iranian oil in Iran or through STS operations in 2021-2023, as per Kpler.

Russia also continues to evade shadow fleet sanctions by transferring sanctioned tankers to new entities. For instance, when four UAE-registered shipping companies, sanctioned by the UK, passed tankers to other Emirati firms, they continued commercial operations under new management. Similarly, Stream Ship Management Fzco became the top shipper of Russian crude oil after acquiring tankers previously managed by Oil Tankers Scf Mgmt Fzc, sanctioned by the OFAC.

Maintenance and expansion of the shadow fleet enables Russia to bypass the oil price cap. In March 2024, the average Urals FOB Primorsk and Novorossiysk, as well as ESPO FOB Kozmino, increased by ~$2 per barrel, to levels well above price cap threshold. The discount of Urals FOB Primorsk and ESPO FOB Kozmino to Dated Brent decreased by ~$0.4 per barrel over the previous month.

UAE, Chinese and Greek ship managers have played a leading role in transporting Russian crude. In March 2024, 8 of the top 10 shippers of Russian crude were registered in the UAE or China. As for Russian oil products exports, Greek companies dominated the top shippers, although Modern Gemi Isletmeciligi As (Turkey) and Oil Tankers Scf Mgmt Fzco (UAE) led the list in March.

KSE Institute projects Russian oil revenues to reach $175 billion and $152 billion in 2024 and 2025 under the base case with current oil price caps and stronger sanctions enforcement. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $206 billion in 2024 and $195 billion in 2025.

Contacts