🇷🇺 Oil Revenues Slightly Decreased Despite Constant Sanctions Violations

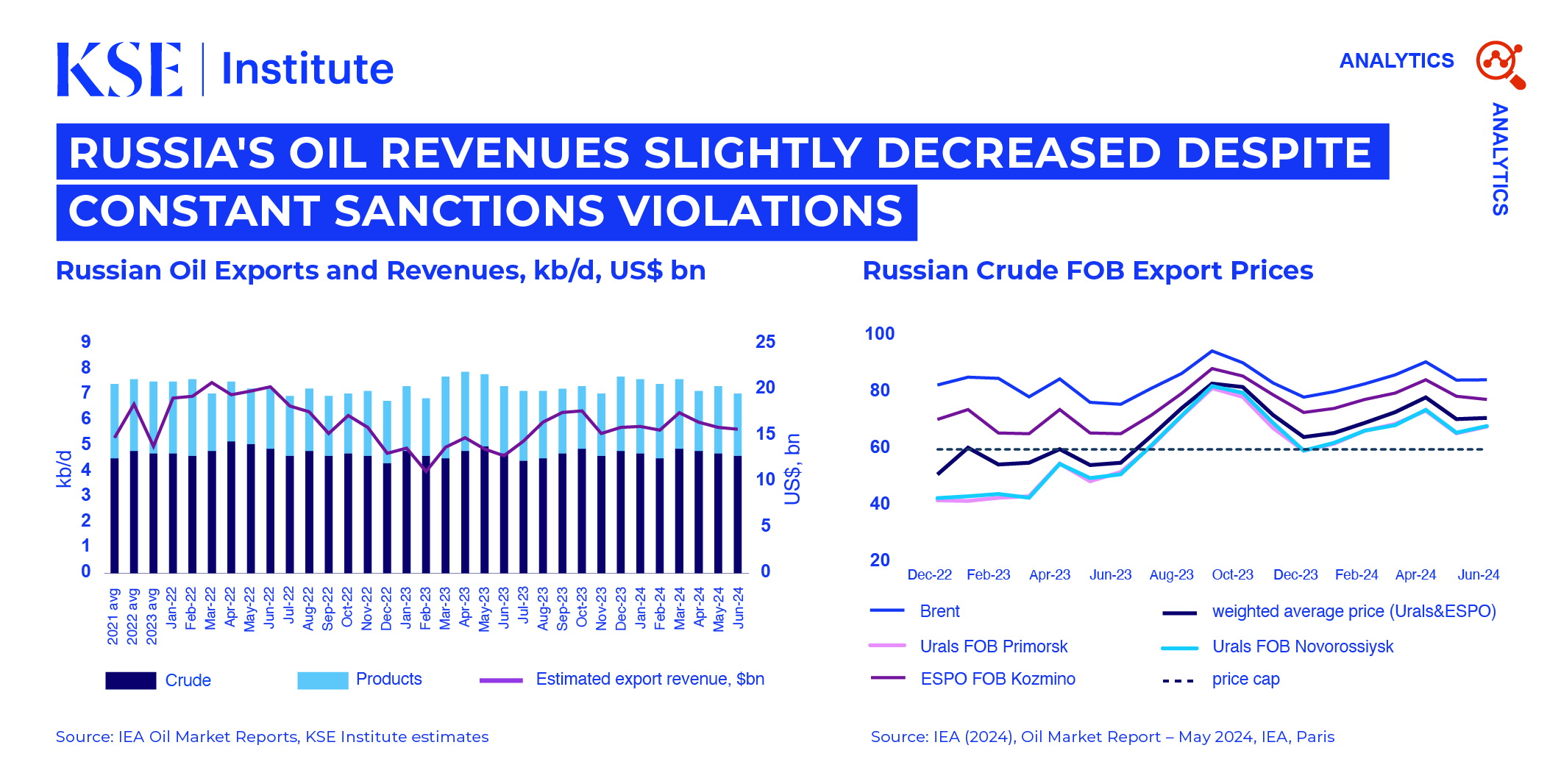

In June 2024, Russian oil export revenues declined for the third consecutive month to $16.7 billion due to reduced product exports, according to the KSE Institute’s July ‘Russian Oil Tracker.’ Despite the decline, crude and discounted oil products were traded well above the EU/G7 price cap, and the shadow fleet’s share of oil shipments continued to grow.

Russian seaborne oil exports remained stable in June. Although seaborne crude shipments rose by 2.0% MoM, oil product exports fell by 4.0% (130 kb/d), leading to reduced oil revenues for the month.

In June 2024, crude oil revenues totaled $11.0 billion, with $7.7 billion from seaborne shipments subject to the price cap. The prices of Urals FOB Primorsk and Novorossiysk increased by $2.2 per barrel, reaching around $68 per barrel. Oil product revenues amounted to $5.7 billion, with $4.6 billion from shipments subject to the cap. Premium products traded below the cap, while discounted products traded above it. Rigorously enforcing and lowering the cap by $15 per barrel for crude and discounted products, and by $30 per barrel for premium products, would have reduced revenues by $2.6 billion in June.

Russia’s active use of the shadow fleet allows it to bypass the price cap. In June, 209 loaded Russian shadow fleet tankers left Russian ports, with one involved in STS transfers. Notably, 84% of these tankers were over 15 years old. Russian reliance on Western maritime services fell to 29%, while crude oil exports by the shadow fleet increased by 3% to 89%. These uninsured old vessels, not owned or managed by the EU/G7, increase the risk of oil spills, potentially causing billions in environmental damages for which Russia is not liable.

As of July 15, 2024, the US, EU, and UK imposed sanctions on 55 tankers for transporting Russian oil exports. Russia tested the impact of these sanctions as four tankers returned to service after being idle. Other sanctioned tankers have been removed from commercial operations. On July 18, 2024, the UK imposed sanctions on an additional 11 tankers for carrying Russian oil above the price cap.

UAE, Chinese, and Greek ship managers assist Russia in circumventing sanctions. Stream Ship Management Fzco has topped the list of the ten largest crude shippers for a fourth consecutive month after acquiring tankers from sanctioned OFAC Oil Tankers Scf Mgmt Fzc. Four Chinese companies from the list of top ten Russian crude shippers were responsible for 11% of Russian seaborne crude exports.

India, China, and Turkey sustain demand for Russian oil, accounting for 96% of Russian crude oil exports. India, the largest importer of Russian seaborne crude, increased its imports by 6% to 1,999 kb/d. Turkey remained the top buyer of Russian oil products and the third-largest buyer of Russian crude, importing 394 kb/d of oil products and 448 kb/d of crude oil.

KSE Institute projects Russian oil revenues to reach $185 billion and $144 billion in 2024 and 2025 under the base case with current oil price caps and stronger sanctions enforcement. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $202 billion in 2024 and $190 billion in 2025.

Contacts