Targeted Sanctions on Shadow Fleet are Working, but 🇷🇺 Seeks Ways to Bypass

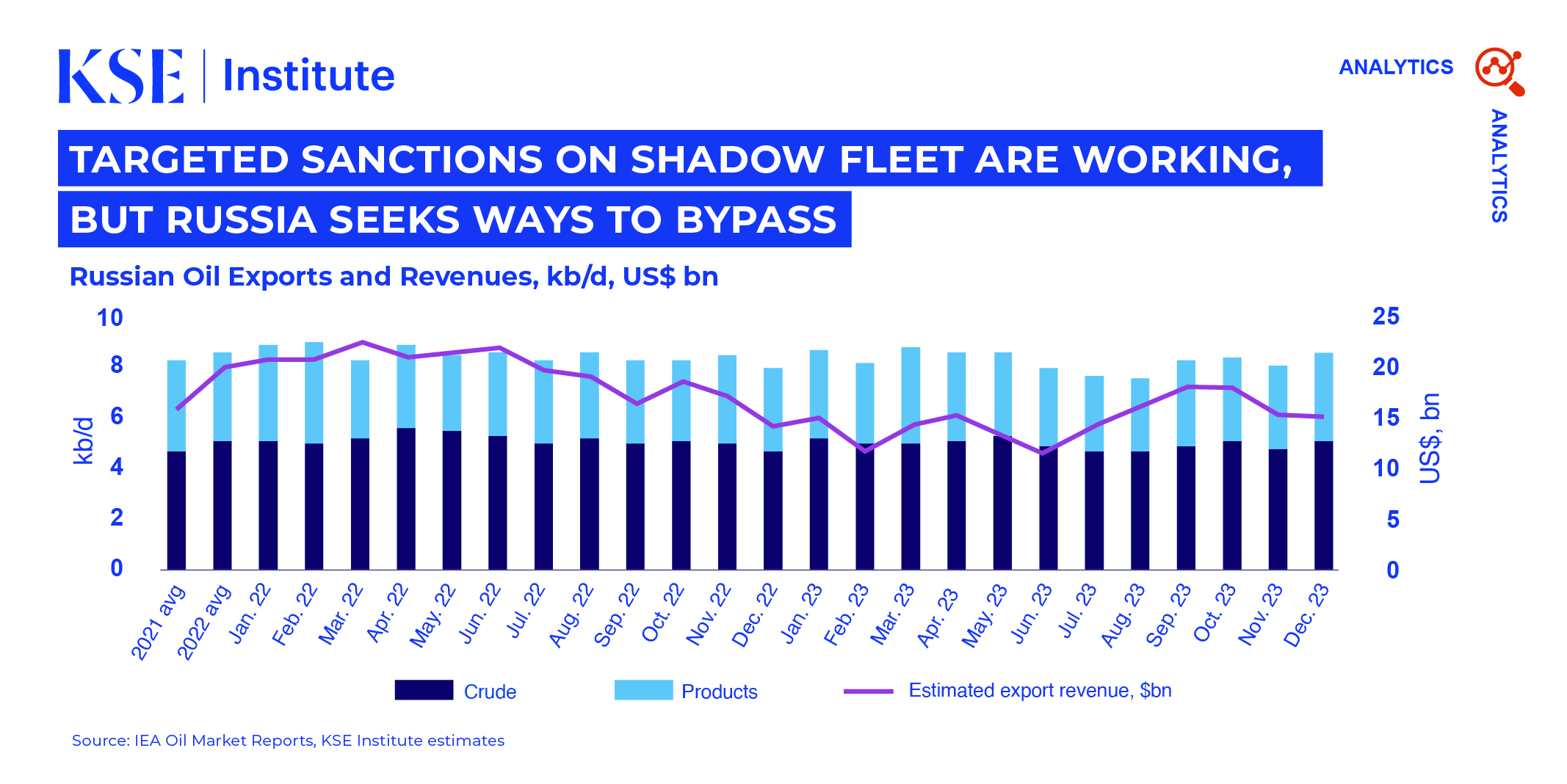

The US Treasury’s active sanctions on the Russian shadow fleet lead Russia to expand it and reduce reliance on Western maritime services, according to the February ‘Russian Oil Tracker’ by KSE Institute. Despite persistent efforts by Ukraine and its allies, Russian export volumes and revenues remain consistently high, underscoring the need for more decisive and swift actions.

The US Treasury’s active sanctions on the Russian shadow fleet lead Russia to expand it and reduce reliance on Western maritime services, according to the February ‘Russian Oil Tracker’ by KSE Institute. Despite persistent efforts by Ukraine and its allies, Russian export volumes and revenues remain consistently high, underscoring the need for more decisive and swift actions.

In January, Russia continued to reduce its dependence on Western maritime services, with only 20% of crude and 51% of oil products shipped with IG P&I insurance coverage. Specifically, the coverage varied by port: 42% from the Black Sea ports, 38% from the Baltic Sea, 22% from the Arctic Ocean and 14% from Pacific Ocean ports had insurance.

Russia further increased the utilization of the shadow fleet in its oil exports. In January 2024, 209 loaded Russian shadow fleet tankers left Russian ports, with 83% of them being more than 15 years old, posing huge environmental risks for the EU. Two more non-IG insured supertankers were also involved in STS transfers, totalling the number of shadow fleet tankers to 211. The shadow fleet was responsible for exporting around 2.7 mb/d of crude (a 7% increase MoM to 78%) and 1.0 mb/d of oil products (an 8% increase MoM to 45%).

Despite the shadow fleet challenge, there are positive signals as efforts to counter its operation have increased in recent months as OFAC’s sanctions on tankers carrying oil sold above the price cap has removed them from regular commercial service. As of February 20, 2024, the US Treasury has already sanctioned 27 vessels carrying Russian crude: 16 tankers were unloaded with no scheduled voyages, 8 loaded ones are stationary, and 3 have planned shipments but without a final destination.

Notably, due to OFAC sanctions, Sun Ship Management (SSM) fell from second to seventh position among top 10 crude shippers. SSM, managing 83 tankers by the middle of July 2023, transferred almost its entire tankers fleet to Oil Tankers Scf Mgmt Fzco and other UAE registered companies. By February 20, 2024, only 4 vessels left under SSM, indicating an actual halt of its operations.

This move was part of Russia’s strategy to bypass sanctions by changing tanker management. Even after OFAC sanctioned Oil Tankers Scf Mgmt Fzco on January 16, 2024, the company simply started transferring tankers to a new entity. However, it still ranked as one of the top shippers, handling ~18% of Russian crude shipments in January.

As for Russian oil product exports, Turkey’s Beks Tanker Isletmeciligi As topped the list in January, replacing UAE’s Oil Tankers Scf Mgmt Fzco, which fell to ninth place even before OFAC sanctions on February 2, 2024. Six out of the ten largest shippers were Greek companies in January, up from three in December and five in November 2023.

Despite sanctions, Russian oil export revenues increased by $0.3 bn to $15.6 bn in January, with minimal changes in oil exports (+0.7% in crude oil; -2.0% in oil products). Notably, India led in seaborne crude imports at 1.6-1.7 mb/d, and Turkey topped oil product imports at 504 kb/d. This robust demand for Russian oil is supported by significant price discounts. Average Urals FOB Baltic and Black Sea increased by 2.3/bbl and 2.5/bbl to around $62/bbl, while ESPO FOB increased by $1.4/bbl to $73.6/bbl.

KSE Institute projects Russian oil revenues to contract to $156 bn and $141 bn in 2024 and 2025 under the base case with current oil price caps and stronger sanctions enforcement. Lowering the price cap to $50/bbl discount to forecast Brent prices would result in revenues falling to $95 bn and $61 bn in 2024 and 2025. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $187 billion and $181 billion in 2024 and 2025, respectively.

Contacts