KSE Institute has published its March Russia Chartbook “Further Weakening Of Russian Macroeconomic Stability Will Require Additional Measures.” Russia’s foreign trade has stabilized at a new post-sanctions baseline, where exports are down and imports have largely recovered. On the fiscal side, increasing expenditures are driving up the budget deficit. We expect that drained macro buffers will significantly constrain policy space going forward and that the economy’s underlying vulnerabilities will surface once the war-related fiscal stimulus is withdrawn. Russia’s shadow fleet is also coming under increased pressure as tanker designations by OFAC have proven to be an effective strategy. Nonetheless, more action is needed to further erode Russian macroeconomic stability and curb its ability to wage war.

Recent positive developments regarding energy sanctions – a re-widening of the discount on Russian oil – result from enforcement actions by OFAC, specifically the listing (i.e., sanctioning) of individual shadow fleet tankers. These measures are increasingly disrupting Russia’s ability to evade the price cap. OFAC has so far designated 41 vessels as assets of sanctioned entities. Only 5 tankers are completing pre-sanctions voyages; the others are unloaded without scheduled voyages or cannot find buyers for their cargo.

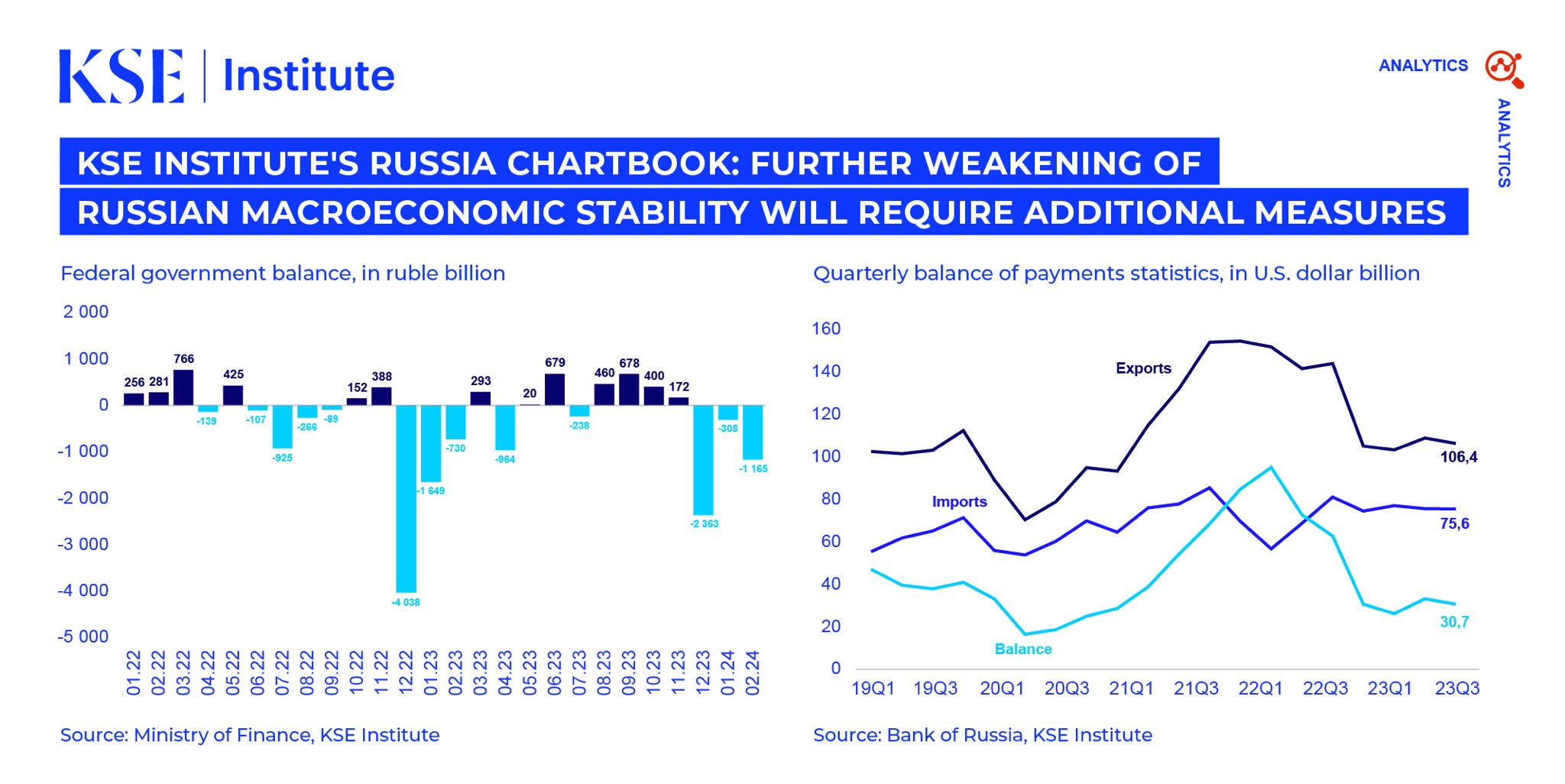

Taking a broader view, Russia faced tougher external conditions in 2023 as its foreign trade stabilized at ~$100bn in exports and $75bn in imports per quarter. This led to a significant decrease in the trade and current account surplus – by 62% and 79%, respectively, compared to 2022. Consequently, the ruble saw continuous depreciation pressure, prompting the CBR to implement sharp interest rate hikes and reintroduce capital controls.

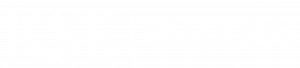

In addition, Russia’s budget deficit rapidly grew in the first two months of this year. Increased spending in January-February has pushed the deficit to 92% of the full-year plan, reaching 1.5 trillion rubles. Due to uncertainty about future revenue collection, Russian authorities are considering raising individual and corporate income taxes, totaling 4 trillion rubles.

To finance its budget in 2022-23, Russia depleted important macro buffers, limiting policy space this year and beyond. Since February 2022, Russia has used up half of the NWF’s liquid assets, including all hard currency. In addition, the central bank does not have access to around $300 billion in its reserves due to sanctions. While some may point to the 3.6% GDP growth in 2023 to argue for the resilience of the Russian economy, it is crucial to note Russia’s shift to a wartime economy, where military spending ($100B in 2024) drives its GDP growth (+2,5% in 2024). Once this stimulus ends, the fundamental problems of the economy – lack of investment and skilled labor – will seriously constrain growth.

While Russia’s external environment has become much more challenging, stepping-up pressure will require additional measures by Ukraine’s allies. Despite the initial success of OFAC’s new strategy, Russia continues to earn large amounts of foreign currency from its energy exports, with rising global oil prices providing support. After the average price for Urals fell below the $60/bbl price cap in December, it rose again to $62/bbl in January and reached $66-67/bbl in February. The $3.40/bbl rise in the average export price delivered ~$470 million in additional earnings from crude oil last month. In addition, budget revenues from oil and gas recovered in February, driven primarily by rising prices, changes to the energy tax regime, and a persistently low level of compliance with the price cap.

In order to expose Russia’s economic vulnerabilities, KSE Institute proposes to strengthen price cap enforcement, continue targeting the shadow fleet, lower the price caps on crude oil and oil products, complete the ban on Russian hydrocarbons, and target oil and gas-related services that Russia relies on.