🇷🇺 High Oil Revenues and Sanctions Evasion Tactics Require Stronger Monitoring by Coalition Countries

*November issue temporarily covers crude oil only

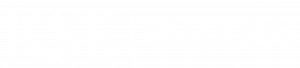

In October 2024, Russian oil export revenues increased by $1.2 billion to $15.6 billion due to higher prices and stable exports volumes, according to KSE Institute’s November ‘Russian Oil Tracker.’ Russia utilizes Iranian and Venezuelan-linked tankers, supported by ship managers and ‘convenience flag’ countries. The sanctions coalition must strengthen monitoring of Russia’s evolving sanctions evasion tactics to effectively counter violations.

Russian seaborne crude exports rose by 4.0% MoM in October, with reliance on Western maritime services increasing by 5% MoM to 13%. IG-insured tankers covered 22% of crude exports from Black Sea, 20% from the Baltic, 2% from the Pacific, and none from the Arctic.

The majority of Russian crude exports continue to rely on the shadow fleet. In October, 85% of shipments were carried by shadow tankers. A total of 111 loaded shadow tankers with crude left Russian ports, with one involved in ship-to-ship transfers and 84% of the vessels over 15 years old. These uninsured, aging vessels pose environmental risks in European waters and help Russia evade the $60 per barrel price cap to fund its war against Ukraine.

Russian oil export prices rose in October, with Urals FOB Primorsk and Novorossiysk increasing by $1.0 and $1.3 per barrel to approximately $63.0 per barrel. The discount to ICE Brent widened to $12.9 and $12.4 per barrel, respectively.

India, China, and Turkey remain key buyers of Russian crude. In October 2024, India imported 1,865 kb/d, 53% of Russia’s seaborne crude exports. Shipments to Turkey surged 2.5 times to 329 kb/d after SOCAR’s STAR refinery resumed operations. Russia continues to use ‘convenience flags’ like Panama, Barbados, and Gabon for oil transport. Moreover, UAE and Chinese managers facilitate shipments above the price cap, aiding sanctions evasion through attestation fraud, ship-to-ship transfers, and disabling vessel tracking.

As of November 18, 2024, the US, EU, and UK imposed sanctions on 103 tankers involved in transporting Russian oil. In response, Russia is testing the sanctions’ effectiveness, with 23 designated tankers returning to service after staying idle for a long time and 9 planning voyages post-designation. Meanwhile, other sanctioned tankers have been removed from commercial operations following coalition measures.

U.S. sanctions targeting Iran and related entities further restrict Russia’s access to shadow tankers for oil transportation. These measures, under SDGT (Specially Designated Global Terrorists) and IRAN-EO13846 (US sanctions on Iran) programs, ban 133 tankers from legal operations on international markets. Despite these restrictions, Russia has partially bypassed them, with 25 of these tankers loaded and/or transported Russian oil using STS operations between January 2023 and August 2024.

Nevertheless, Russian oil is transported on tankers used for sanctioned Iranian and Venezuelan oil. The Chinese manager Prominent Shipmanagement Ltd used its tankers Cankiri and Sakarya to transship Russian crude onto the Atila, a vessel also involved in transporting Iranian and Venezuelan oil. The Atila is owned by the opaque Grat Shipping Co Ltd, registered in Seychelles.

KSE Institute projects Russian oil revenues to reach $193 billion and $137 billion in 2024 and 2025 under the base case. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $167 billion in 2025 and $165 billion in 2026.

Contacts