Russia’s Oil Revenues Slightly Decline Amid Lower Global Prices, Stronger Coalition Action Needed to Curb Shadow Fleet

*October issue temporarily covers crude oil only

*October issue temporarily covers crude oil only

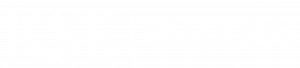

In September 2024, Russian oil export revenues fell to $14.7 billion due to lower global prices rather than stronger sanctions, according to the KSE Institute’s October ‘Russian Oil Tracker.’ Despite intensified coalition sanctions on shadow fleet tankers, Russia continues to rely heavily on this fleet for crude exports and explore ways to bypass restrictions.

Russian seaborne crude exports rose by 8.6% MoM in September, with only 8% covered by IG P&I insurance, down from 10% in August. Black Sea exports fell by 10.6% MoM, now fully reliant on shadow fleet tankers without IG insurance, compared to 16% coverage in August. Baltic exports rose by 30.2% MoM, with IG-insured shipments at 16%. Pacific and Arctic port coverage remained low at 2% and none, respectively.

Although Russian crude and product exports rose by 0.5 mb/d, this increase could not offset falling oil prices, leading to lower revenues. Urals FOB Primorsk and Novorossiysk dropped by $6.9 and $6.5 per barrel to around $62 per barrel, with discounts to ICE Brent slightly widening to about $11 per barrel.

Russia’s extensive use of shadow fleet tankers has turned bypassing oil price caps into a common practice. In September, 112 shadow tankers loaded with crude left Russian ports, with 79% over 15 years old. In addition, two very large crude carriers (VLCCs), too large to be loaded at Russian ports, conducted STS transfers. Beyond extra profits, these aging tankers pose significant environmental risks, increasing the likelihood of oil spills.

To broaden its shadow fleet operations, Russia has been shifting former Sovcomflot tankers among different managers to mask actual ownership. Since August 2024, part of tankers have moved from Sovcomflot-linked firms to three new Emirati companies and one Turkish company. Currently, 16 tankers are managed by these Emirati firms, with 12 already sanctioned by the UK. All three Emirati companies share the same address in Dubai.

The US, EU, and UK have intensified sanctions against Russia’s shadow fleet, removing vessels from commercial operations. As of October 21, 92 tankers were sanctioned for transporting Russian oil. Testing these measures, Russia returned 22 of these tankers back into service after staying empty and idle for a long time, with 17 navigating through or near EU and G7 waters. The other 70 tankers remain out of commercial use.

UAE and Chinese ship managers remain key in aiding Russia’s crude exports beyond the price cap. Stream Ship Management Fzco (UAE) topped the list of shippers for a seventh consecutive month, handling 13% of exports in September. Six Chinese companies in the top ten accounted for another 15% of seaborne Russian crude exports. These managers use document fraud and STS transfers to obscure oil origins and tanker routes.

Russia uses a double-sale scheme with ship managers to bypass sanctions. In January–September 2024, Russian companies sold 36.7 million barrels of crude oil on FOB terms to other domestic firms, mainly Lukoil and Gazprom. This setup allows insurance at a capped price, as sellers avoid export-related risks. The oil is then resold on DES terms to final customers at a higher price, with Russian companies nominally guaranteeing export security for crude shipments without actually providing it. This tactic enables sales above the price cap without proper insurance, obscuring final sale prices and complicating regulatory checks.

India, China, and Turkey continue to be the main buyers of Russian crude, making up 98% of crude exports. India increased imports by 13.5% to 1,848 kb/d, while China raised its import volumes by 15.6% to 1,358 kb/d. Despite a sharp 33.3% drop in September, Turkey held its spot in the top three, importing 132 kb/d—its lowest level since December 2022.

KSE Institute projects Russian oil revenues to reach $187 billion and $143 billion in 2024 and 2025 under the base case. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $190 billion in 2024 and $174 billion in 2025.

Contacts