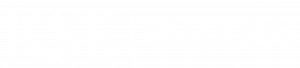

Temporary Surge in Global Oil Prices Yields Limited Revenue Growth

In June 2025, Russia’s oil export revenues increased by $0.8 billion to $13.6 billion month-over-month (MoM), according to the July edition of the Russian Oil Tracker by KSE Institute. The increase was driven by higher prices for crude oil and oil products. Crude revenues grew by $0.7 billion to $8.6 billion amid higher prices and stable volumes, while oil product revenues increased by moderate $0.08 billion to $5.0 billion, as higher prices offset reduced volumes.

In June 2025, Russia’s oil export revenues increased by $0.8 billion to $13.6 billion month-over-month (MoM), according to the July edition of the Russian Oil Tracker by KSE Institute. The increase was driven by higher prices for crude oil and oil products. Crude revenues grew by $0.7 billion to $8.6 billion amid higher prices and stable volumes, while oil product revenues increased by moderate $0.08 billion to $5.0 billion, as higher prices offset reduced volumes.

Seaborne crude exports fell by 2.0% MoM, and oil product exports dropped by 4.2%. Revenues from seaborne oil exports subject to the price cap rose by $0.8 billion to $10.4 billion. Tankers insured by the International Group of P&I Clubs carried 35% of crude oil and 81% of oil products.

According to KSE Institute, 123 shadow fleet tankers transported crude oil and oil products from Russian ports in June. Of these, 85% were over 15 years old, increasing the risk of accidents and oil spills.

In June-July, near the Baltic port of Vysotsk, AIS spoofing was detected involving 17 vessels. Twelve Russian shadow tankers, all designated in multiple jurisdictions, operated under falsified or unknown flags. Notably, Pushpa and Sierra, posing as Malawian-flagged vessels, transited the Baltic Sea undisturbed, masking their actual routes through AIS spoofing.

India remained the largest importer of Russian seaborne crude oil — 1,640 kb/d (49% of seaborne exports, down 6% vs. May). China reduced imports by 8% to 1,132 kb/d. Turkey led in oil product imports (498 kb/d) and ranked third in crude (382 kb/d). Altogether, these three countries accounted for 95% of Russia’s seaborne crude oil exports in June.

As of July 24, 2025, the EU, US, UK, Canada, Australia, and New Zealand had imposed sanctions on 535 Russian oil tankers.

In June 2025, Urals grade was traded below the G7/EU price cap, while ESPO exceeded the cap due to rising global oil prices. Premium oil products, as in previous months, were priced well below the price cap, which remains too high. Meanwhile, discounted oil products began trading above the set limit again.

According to updated KSE Institute estimates, with current price caps and sanctions, Russia’s oil revenues could fall to $152 billion in 2025 and $131 billion in 2026 (compared to $189 billion in 2024 and $185 billion in 2023). If discounts on Urals and ESPO widen to $40 and $30 per barrel, respectively, revenues could drop to $112 billion in 2025 and $49 billion in 2026. However, with weak sanctions enforcement, Russia could earn up to $163 billion in 2025 and $151 billion in 2026, retaining significant resources to fund its war against Ukraine.

Overall, according to KSE Institute, Russia’s total oil export losses from March 2022 to June 2025 amounted to $155 billion due to sanctions, price caps, and discounts on its oil.

Contacts